15.11.2023

Commentary

Global economies compete for the benefits of the electric transition and traceability can ensure regions reap full benefits

The world is making a historic transition. What powers our cars and homes is shifting from fossil fuel based to critical minerals based and this requires completely different resources, supply chains, and skillsets.

Looking solely at what powers our transportation and gets us from A to B, electric vehicles (EVs) are expected to grow in number from 27 million passenger electric vehicles on the road today to 731 million by 2040. Across all transportation segments, the shift to EVs equates to $8.8 trillion in economic opportunity by 2030 and $571 trillion by 2050, according to Bloomberg New Energy Finance’s (BNEF’s) Economic Transition scenario.

Making this transition effectively means accelerating lithium-ion battery output from 1.1TWh today to 15TWh in 2050—and all these terawatt hours mean potential jobs, R&D investment, innovation, and economic prosperity for countries around the world. It is therefore no surprise that batteries are now central to many countries’ industrial and international policy agendas.

Building our global critical minerals-based economy is naturally creating geopolitical, environmental, and societal tension. What are some key geographies to watch, and how is supply chain visibility and traceability solution in this transition unlike any transitions before?

Africa

Looking to Africa, the continent holds a third of the world’s critical minerals. Understandably, countries within the African continent want more economic prosperity than what will be derived from extracting ore from the earth—they want the jobs and community development that compound with stable and long-term investment and when materials are also processed and manufactured within borders.

The rest of world is also counting on Africa’s critical mineral wealth. Fueled by pursuits for climate security as well as national and economic security, the Biden Administration, as an example, is making arrangements within African countries to build local development in the form of railroad lines, hospitals, schools and more. The Lobito Corridor project—which connects Zambia’s Copperbelt province via rail to existing lines in neighboring Angola—will equate to $1.6B in investment, representing the most significant transportation infrastructure project that the U.S. has helped Africa with in over a generation.

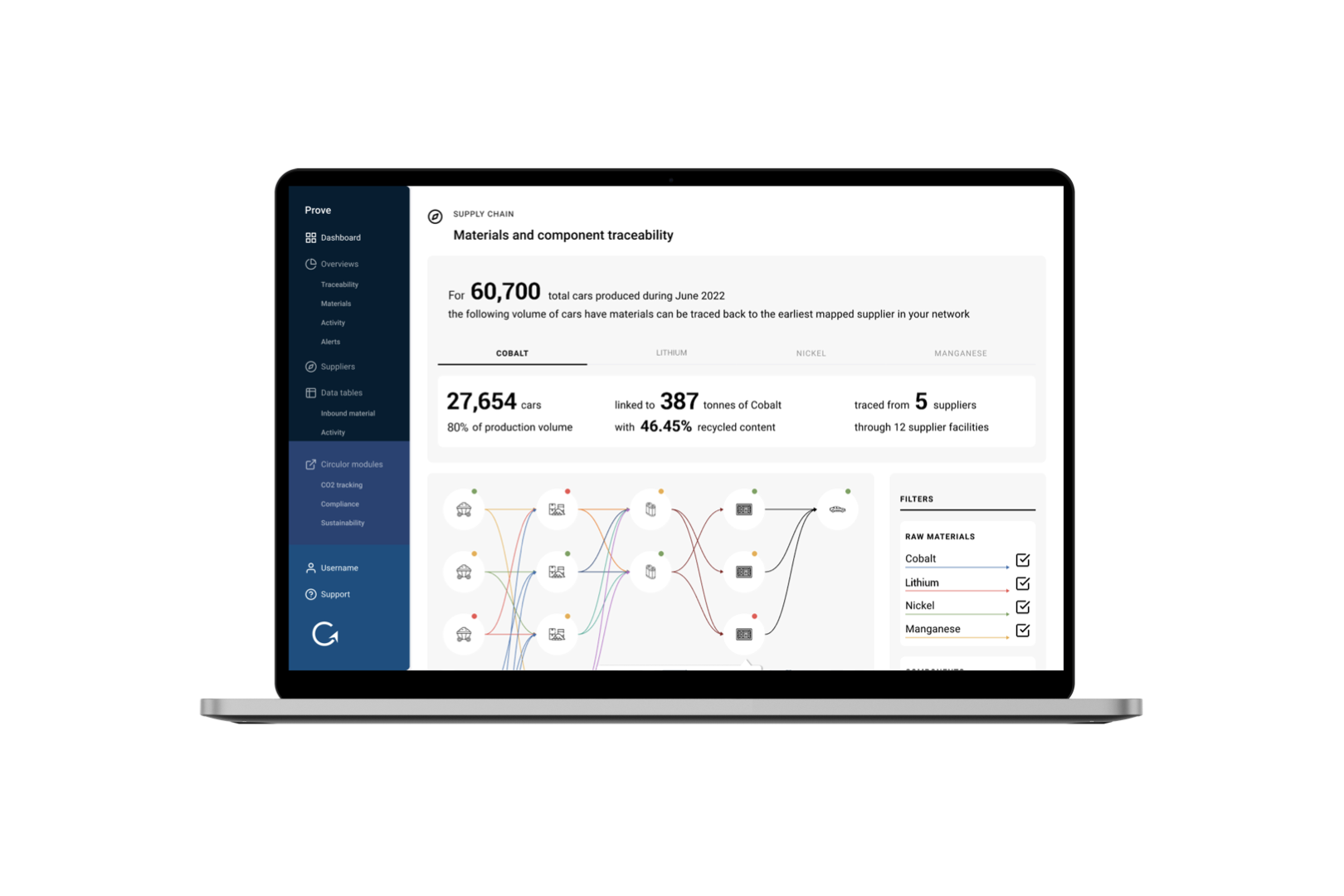

As Africa’s attractiveness becomes more self-fulfilling, the incorporation of supply chain visibility and end-to-end material traceability from mines to batteries demanded in other parts of the world can ensure for upstream African countries that materials are in fact staying longer and further down the supply chain within respective borders. For global investors—both private and public—traceability brings data and proof that social and environmental agreements in the upstream are being met and upheld.

South America

The battery industry’s needed volumes of lithium are expected to increase ten-fold between now and 2040, and a region critical to providing these supplies is South America’s “Lithium Triangle.” Making up 60% of the world’s known lithium reserves, the Lithium Triangle is especially attractive to countries lacking in such abundances as they establish long-term partnerships to secure sustainable resources essential in making the electric transition.

Part of Europe’s Critical Raw Materials Act (CRMA), which reached a provisional deal on Monday 13 November, focuses on mutually beneficial partnerships with other economies, notably through the Global Gateway Strategy to provide these countries with a vehicle to develop their own extraction and processing capacities, as well as skills development.

In executing the Global Gateway, the EU Commission has signed a Memorandum of Understanding (MOU) with key Lithium Triangle player, Argentina, to ensure development of secure and sustainable raw materials needed to accelerate lithium-ion battery output by 2050. To do this, the collaboration between the bloc and Argentina includes integrating sustainable raw material value chains into processing capacities, strengthening R&D, vocational education and skills, and leveraging ESG criteria that align with international standards. The roadmap for this partnership also includes cooperation with broader Latin American and the Caribbean countries (CELAC), currently the EU's fifth largest trading partner, to expand the network of strategically and mutually beneficial partnerships that secure sustainable resources.

For Argentina and the mining companies operating there, they can expect out of this partnership the development of joint projects and the facilitation of trade and investment linkages –as long as high ESG standards are continuously upheld. By implementing material traceability to prove responsible and sustainable activities, it creates differentiation as to where to focus investments that will increase the production of sustainable lithium and garner a higher value along the supply chain and with downstream consumers.

For Europe, the continent admittedly “needs to mitigate risks related to strategic dependencies to enhance its economic resilience, while achieving its climate objectives.” Such partnerships with Argentina and CELAC countries, especially when coupled with supply chain visibility as needed for Europe’s Battery Regulation and Critical Raw Materials Act, can mitigate risks, and ensure responsibility and circularity.

Western Allies

A number of western countries came together in June of 2022 to establish the Minerals Security Partnership (MSP). Consisting of 14 partners and representing over 50% of global GDP, MSP countries aim to catalyze public and private sector investment in responsible critical mineral supply chains globally.

The MSP is expected to name a dozen projects around the world that are keenly important to supplying the world’s resources of lithium, cobalt, nickel, graphite, and manganese. These projects will also demonstrate what it means to uphold responsibility and sustainability and adhere to levels of transparency required for public and private investment.

For these MSP countries, it is a fine line between deploying clean energy technologies at scale to meet their individual decarbonization goals—such as 50% electric vehicles on their roads by 2050—while ensuring that critical mineral supply chains are built in ways for resilience to meet these goals and do not negatively affect people or planet in other geographies.

As Benchmark Minerals astutely points out in their recent “Net Zero 2050 and the Battery Arms Race” report, “understanding the upstream dynamics, all the way to the mine, is central to working out whether rapid scaling is possible and how quickly we can achieve Net Zero.” So, while specific projects can help in bringing more supply on to the global market, it will be the coupling of upstream projects with end-to-end material traceability of full supply chains that will yield the most progress for global collaboration, economic resilience, and climate action.

More specifically, material traceability for western upstream producers like those in Canada, Australia, the U.S., et al will mean the opportunity to verify materials’ provenance and showcase how their greater investments in extraction and processing creates greater responsibility and sustainability. The connecting of upstream activities with downstream incentives and market access—based on the actual flow of materials—can then galvanize the industry to grow in purposeful collaboration.

In Conclusion

The electric transition offers much to be gained...and much that can be potentially lost. Success in this global transformation is not a given and the winners will surely be those who think ahead, innovate in areas of environmental monitoring and traceability, and effectively create international and industrial collaboration between the upstream and the downstream.

![Acculon RA Circulor - website image.001[44].png](/_next/image?url=https%3A%2F%2Fdecisive-wonder-fa24533282.media.strapiapp.com%2FAcculon_RA_Circulor_website_image_001_44_2720fb315d.png&w=1920&q=75)