13.09.2023

Commentary

In Pursuit of a Secure and Transparent Clean Energy Economy, the U.S. Requires Growing Sourcing and Disclosure Requirements

Now one year since the passage of the Inflation Reduction Act (IRA), it has become increasingly clear in the U.S. that supply chain transparency and traceability are essential to building the clean energy economy with confidence and clarity.

Marking the IRA anniversary, the U.S. Department of Energy (DOE) released a report showcasing that nearly every county in the U.S. experienced energy job growth in 2022, with a large portion of that growth focused on solar and motor vehicle industries and their component partsi. But alongside this economic growth in the U.S. are new questions and elevated concerns about the security of the supply chains that enable these industries, illuminating the impact of their geopolitical, environmental, and human rights footprints.

The contents, locations, entities, and practices involved in critical infrastructure supply chains are increasingly top of mind for the Biden Administration and a bipartisan swath of members of Congress. Here we break down growing interest and requirements in the U.S. for supply chain transparency, and how they are driving the conversation for greater economic, national, and climate security.

Clean Vehicle Tax Credit Content Requirements

The IRA reinstituted the EV tax credit for U.S. consumers. Differing from previous iterations of the credit, the newly written Clean Vehicle Credit (referred to as Section 30D in U.S. Code) includes content requirements for the minerals and components in a vehicle’s battery.

The $7,500 credit is now bifurcated, with $3,750 for vehicles meeting certain critical mineral requirements, and $3,750 for vehicles meeting certain battery component requirements. To prove a vehicle qualifies for either portion of the credit, OEMs must use a value-added calculation to demonstrate that a certain percentage of Free Trade Agreement (FTA) sourced critical minerals and/or North American battery components is met. The implementation of content requirements, and the methodology proposed to calculate vehicle eligibility, thereby requires total transparency into battery supply chains.

Despite the U.S. Department of Treasury issuing multiple rounds of guidance on 30D implementation, many questions remain, most notably that of the Foreign Entity of Concern (FEOC) definition. By 2025, OEMs will have to prove that their battery supply chains do not use battery components or critical minerals sourced from FEOCs. This demonstrates a U.S. commitment to ensuring federal dollars do not benefit U.S. adversaries and encouraging onshoring within North America and with U.S. allies.

National Defense Authorization Act (NDAA) Disclosure Requirements

The Department of Defense (DoD) has also been directed by Congress to improve and increase its traceability of minerals, namely those of rare earth elements and permanent magnets critical to energy and defense systems.

The National Defense Authorization Act (NDAA) for fiscal year 2021 (FY21), an annual defense bill, included a section that prohibits the U.S. Defense Department from procuring materials for permanent magnets that are mined, refined, separated, or melted in certain countries. To implement this requirement, the DoD proposed a rule in April 2023 to reflect changes to the permanent magnet sourcing requirements for the Defense Acquisition Regulations System. Implementing the proposed rule requires that DoD works with providers to ensure that no permanent magnet materials acquired by the agency are mined, refined, separated, or melted in the countries identified.

Additionally, the NDAA for FY23 includes a new disclosure requirement for DoD-acquired rare earth magnets. Specifically, this provision requires DoD contractors to disclose the provenance of the magnet, as well as where the rare earth elements and critical materials in the magnet were mined, refined, and manufactured into metals and alloys that are magnetized. This requirement builds on the FY21 NDAA and demonstrates a growing concern from Congress regarding DoD’s dependence on foreign entities for critical technologies.

Notably, current drafts of the NDAA for FY24 include an amendment that would expand this disclosure requirement from FY23 to also apply to critical materials and components within DoD batteries. While we won’t know what will be included in the final iteration of the legislation until later this year, it is evident that dependable supply chain traceability platforms will be increasingly integral to providing security and accountability for supply chains essential to the U.S. defense industrial base.

U.S. Trade, Tariffs, and Diplomacy

The U.S. government has also expanded existing trade and tariff mechanisms in recent years to enhance due diligence and scrutiny of the supply chains that domestic industries import and rely on. To discourage sourcing materials from U.S. adversaries, the federal government has increased tariffs on imports from countries and/or regions it has deemed high risk.

This is especially true in energy markets, given the complexity and global nature of these supply chains, particularly when it comes to the sourcing of critical minerals. A growing number of policies being implemented by the U.S.’s Customs and Border Protection require evidence of where products are mined, processed, and manufactured—enhancing the need of material traceability throughout entire upstream supply chains. At the same time, as noted above, the U.S. is making clear what countries and regions it is willing to work with via mechanisms like Free Trade Agreements, which are tied to eligibility for the Clean Vehicle Tax Credit.

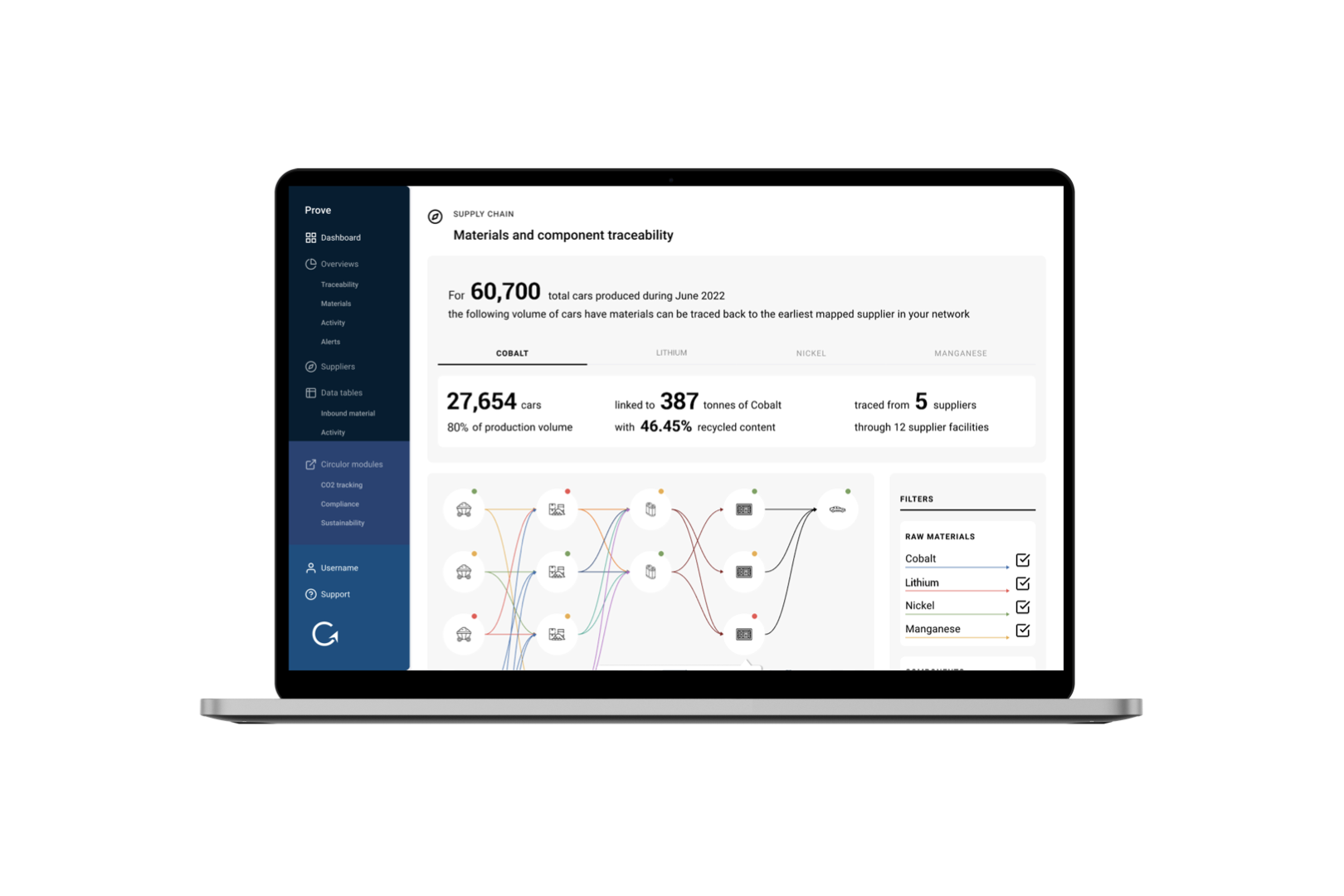

Companies are already looking to traceability providers like Circulor to map out their supply chains and provide proof that their goods fulfill market requirements, as they navigate an increasingly complex web of global procurement standards. More companies are expected to need this capability in the coming years as the U.S. continues to scrutinize clean energy component and technology imports— provenance, material traceability, and responsible sourcing practices—as part of what is becoming a whole-of-government supply chain security initiative.

What’s Next? A Carbon Pollution Fee

While the legislation and programs noted above are still being developed and implemented, Congress continues to explore new policies to drive the sustainable and robust growth of secure energy supply chains. Most recently, this has included discussions on a carbon pollution fee on imports, commonly known as a carbon border adjustment mechanism (CBAM).

Although the concept of imposing a fee, tax, or tariff on imported goods with a high carbon footprint is not new, the growing bipartisan interest among U.S. policymakers certainly is. Most notably, passing CBAM legislation is an increasing topic of interest among a bipartisan mix in the Senate. According to reports, Senator Bill Cassidy (R-LA) is in the process of drafting CBAM legislation, and other Senators including Mitt Romney (R-UT), Kevin Cramer (R-ND), and Sheldon Whitehouse (D-RI) have all also expressed interest and support for similar concepts, although specific approaches differii. As these conversations gain momentum on Capitol Hill, traceability will be essential in the implementation of this type of legislation for the U.S. government and in establishing compliance for importers.

To Summarize

It is evident that supply chain transparency and material traceability are becoming increasingly important in the U.S. as well as across the globe. In addition to the U.S., other countries have implemented, are implementing, or are considering similar sourcing, disclosure, and/or emissions requirements for their critical supply chains, including programs such as the EU Battery Regulation, the German Battery Pass project, and other regulations in countries that include Japan, South Korea, India, Zambia, and others.

As more countries implement product content and pollution regulations, companies will need to navigate increasingly complex regulatory standards with varying requirements. And, despite the varying approaches, these standards demonstrate a growing consensus that with high-risk and high-emission supply chains comes an obligation – and now, a requirement – to source responsibly. Partnering with a trusted supply chain traceability partner is the first step in doing so.

![Acculon RA Circulor - website image.001[44].png](/_next/image?url=https%3A%2F%2Fdecisive-wonder-fa24533282.media.strapiapp.com%2FAcculon_RA_Circulor_website_image_001_44_2720fb315d.png&w=1920&q=75)