29.01.2025

News

January 2025 Newsletter: Opportunities for resilience and competitiveness through transparency

With a historic number of Executive Orders in its first week, the world is still making sense of the Trump Administration, its agenda, and the feasibility of executing its policy priorities.

When it comes to energy and trade, executive orders like “Unleashing American Energy”, “Declaring a National Energy Emergency”, and “America First Trade Policy”, mobilize U.S. federal government departments to assess and ease environmental permitting bottlenecks, boost U.S. fossil fuel and critical mineral production and processing, ensure robust critical mineral supply chains for defense needs, evaluate exploitative foreign practices, and review national security risks tied to mineral reliance and forced labor.

While these executive orders give agencies the coming months to study the issues and report on their findings, it’s without a doubt that policies over the next four years will support stricter sourcing provisions through tariffs, import restrictions, and incentives that evidence "Made in America" and clearly support the buildup of jobs and reindustrialization of the U.S. economy.

On the other side of the Atlantic, growing concerns over bureaucracy, competitiveness, and the unknown impacts of Trump's regulations have sparked calls by industry and national governments for Brussels to trim sustainability rules. As Europe’s Clean Industrial Deal takes shape, it’s critical to remember that sustainability and responsibility are unique value propositions that, when coupled with transparency, can create resilience, industrial opportunity, and product differentiation, setting a new bar for economic competitiveness.

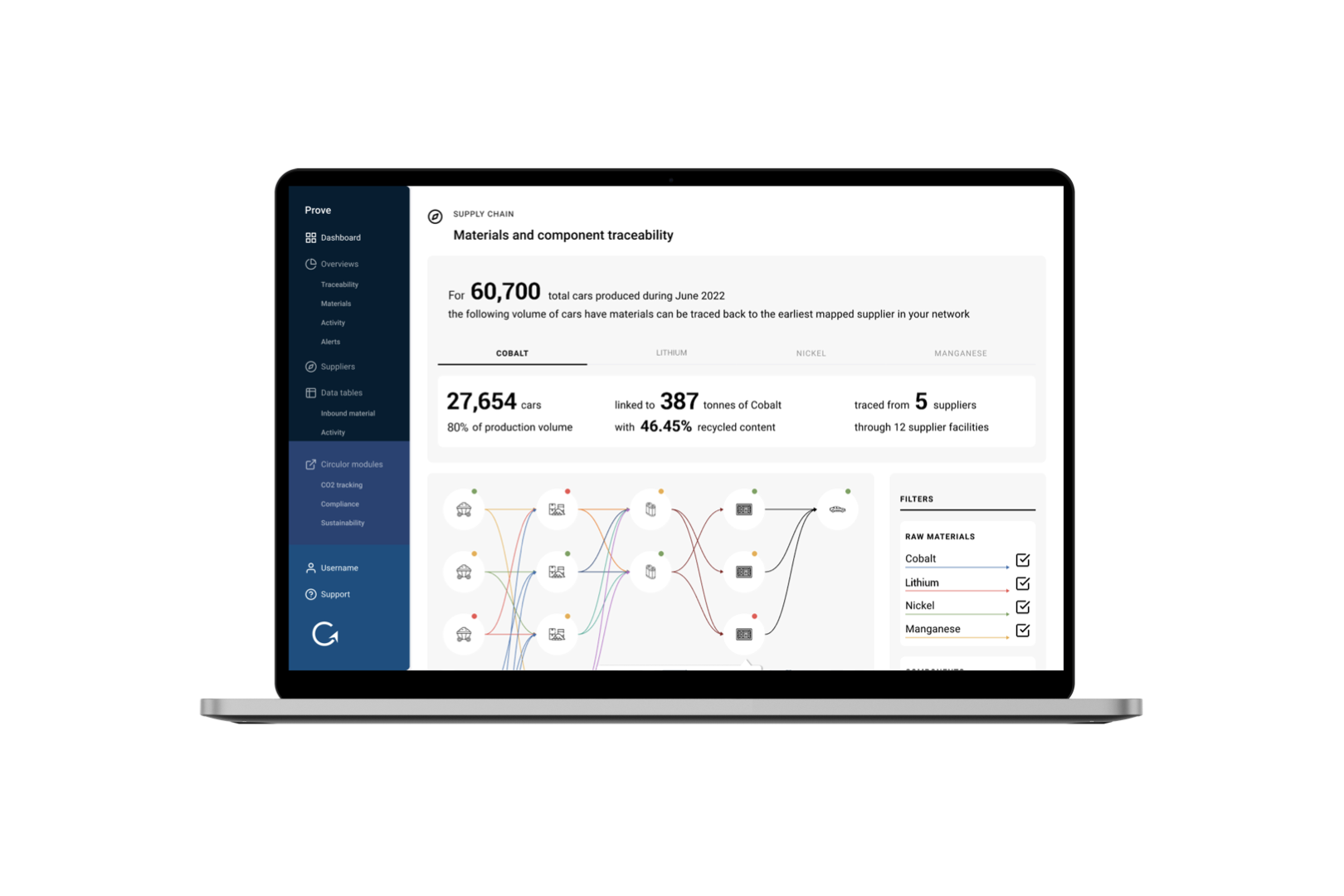

This year, Europe’s “Brussels Effect” evolves as lighthouse due diligence responsibilities come to the fore in the EU Batteries Regulation and EU Deforestation Regulation. As traceability and proof of responsible upstream sourcing become essential for market access, companies that prioritize transparency will be best positioned to capture opportunities and thrive in a rapidly evolving landscape. What’s more is that this upstream intelligence for Europe can also serve other markets as trade, tariff, and responsible sourcing provisions take effect.

The new year brings uncertainty and fluidity—that's clear. However, there remain key certainties that go unchanged. Energy and economic security remain beholden to structural risks; the global economy needs exponentially more energy and materials than available today; and supply chain transparency and material traceability will be key monitoring mechanisms adopted by corporate and market leaders to mitigate risks and accelerate resiliency.

What we're reading...

Trump team has wealth-fund ambitions for a small lending agency

Bloomberg reports that plans are being deliberated on how the U.S. International Development Finance Corp (DFC) could use investments, of as much as $120 billion, to deliver Trump’s ambitions for greater U.S. geopolitical influence. Advisers also see the DFC as a tool to invest in strategic projects like data centers and to help secure supply chains for critical minerals, work that began under the Biden administration.

Resources for Resources: Financing critical minerals supply chains

A recent report by SAFE offers a bold and comprehensive roadmap to securing critical mineral supply chains. It provides policymakers and industry leaders with actionable strategies to address investment barriers and enhance domestic production, while ensuring sustainability and national security. It underscores the serious need for innovative financial tools and international collaboration to close the investment gap and build resilient supply chains.

Emissions and recycling strategies for EV battery supply chains

Battery demand is set to increase four-and-a-half times by 2030 and more than seven times by 2035 under existing policy settings, according to the IEA. The IEA highlights that further widespread efforts on the circularity of batteries will be needed as the market scales, which if implemented effectively, recycling could reduce lithium and nickel demand by 25%, and cobalt demand by 40% in 2050. It also explores how international trade of second-hand EVs can have implications for recycling strategies.

What we're sharing...

Growing opportunities from responsible secondary cobalt

Today, considerable amounts of end-of-life cobalt are not recovered, resulting in a loss of a strategic resource that is essential to the energy transition. Circulor joined a webinar hosted by the Cobalt Institute to explore the critical role of secondary cobalt and the enabling role of battery passports to drive truly resilient and circular battery value chains. With end-to-end traceability needed to calculate and verify the recycled content in batteries, it will encourage local sourcing of end-of-life batteries and scrap, as well as responsible practices, strengthening trust in local suppliers and resource sufficiency. Watch the webinar here.

Battery Pass paves the way for international battery passport standards

In collaboration with DIN, the official German standardization organization, and DKE (German Commission for Electrical, Electronic & Information Technologies), the German-funded Battery Pass project has published the DIN DKE SPEC 99100, providing practical guidance on the requirements for data attributes in battery passports. This pre-normative standard is a critically important input for further standardization of battery passport data in Europe, as well as in the U.S. and globally. Explore the new standard here and find a helpful summary by VDE here.

How will the EU Batteries Regulation impact Africa’s mining and metals sector?

The EUBR introduces the most comprehensive due diligence requirements ever imposed on the mining and metals sector – and these requirements take effect August 2025. Kumi, a trusted partner of the European Commission, is hosting an event during Mining Indaba 2025 in Cape Town on Monday 3rd February, 16:00 – 17:00, to provide invaluable insights into the EUBR’s requirements and implications for the mining and metals industry. Sign-up here.

If you were forwarded this newsletter and would like to sign up, please use this link.

![Acculon RA Circulor - website image.001[44].png](/_next/image?url=https%3A%2F%2Fdecisive-wonder-fa24533282.media.strapiapp.com%2FAcculon_RA_Circulor_website_image_001_44_2720fb315d.png&w=1920&q=75)