09.10.2023

Webinars

Q&A with Douglas Johnson-Poensgen: Unlocking the Pathways to a Circular Economy in the Mining Industry

Circulor’s CEO, Douglas Johnson-Poensgen joined Harry Dempsey of the Financial Times to discuss the mining industry's pivotal role in achieving a circular economy and how supply chain traceability enables this. The panel was part of the FT Mining Summit, where industry leaders explored the impact of geopolitics on reshaping global supply chains and how the industry can deliver the mineral security needed for the energy transition.

Joined by co-panellists, Trond O Christophersen from Norsk Hydro, Louise Assem from the International Copper Association, and Kunal Sinha from Glencore, the panel addressed pressing questions regarding the driving forces behind circularity and why miners are uniquely positioned to champion recycling.

Delve deeper into the topics discussed at the FT Mining Summit through a Q&A with Doug below.

Q. What factors are driving the importance of circular economy for metals?

Johnson-Poensgen: To advance the clean energy economy, not only do we need to increase the supply of metals and materials, but we need to increase the security and diversity of supply, while safeguarding people and the environment. This means doing things differently.

Circular economies address the rising demand for resource security, risk mitigation for business resilience, lower carbon emissions, and compliance with market regulations and incentives.

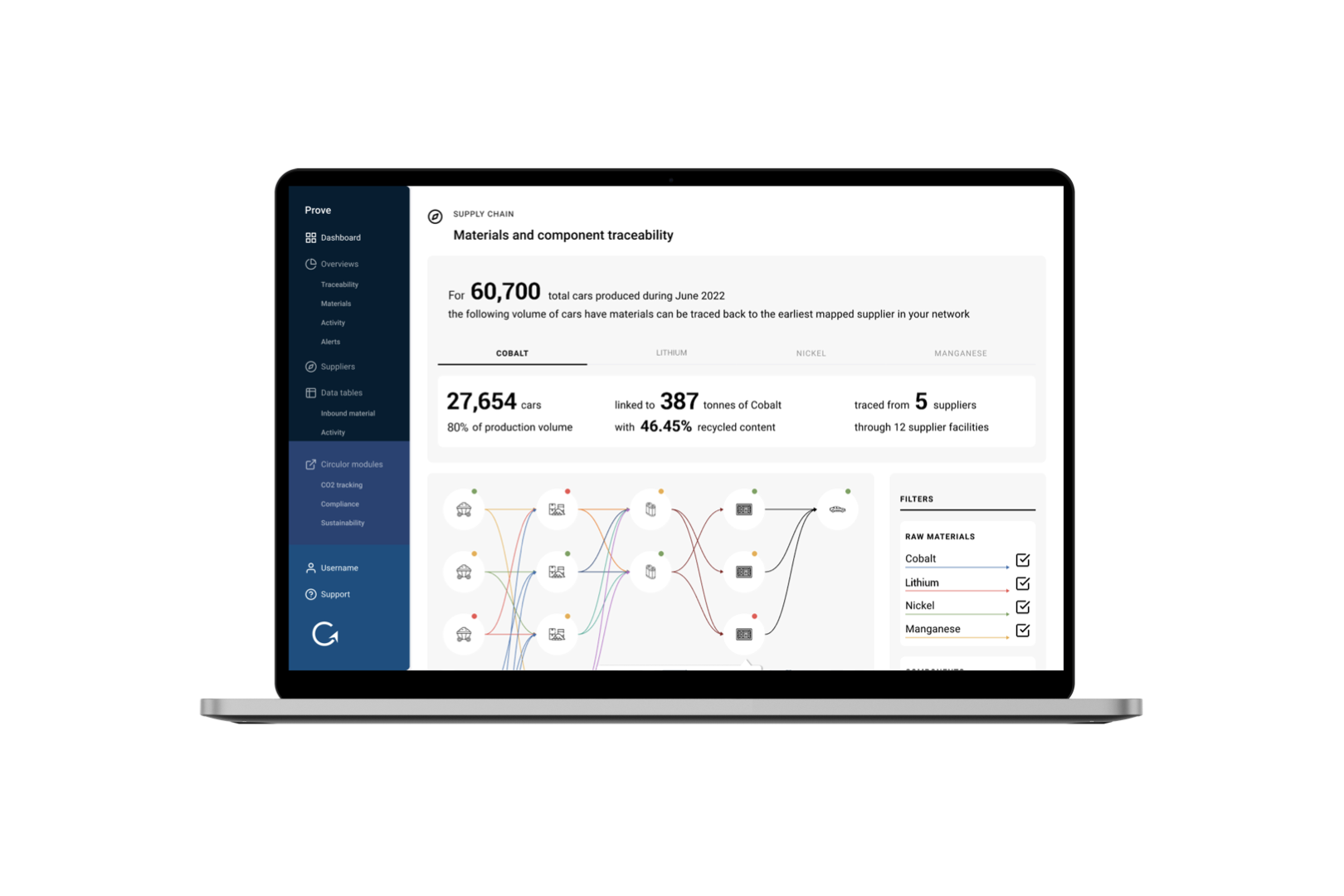

However, unless you can demonstrate the material's recycling, low carbon, regional, and closed-loop attributes it doesn’t do you much good. This is where supply chain transparency and material traceability are critical. Those who adopt these practices now, and integrate them into their materials and products, will establish the standard for what downstream customers expect from their upstream and circular value chains.

Q. Why are mining companies well placed to accelerate this kind of activity?

Johnson-Poensgen: Mining companies are both at the top and the bottom of the value chain, so this segment’s actions and influence are significant. Their opportunities to expand into recycling will grow as scrap and battery asset volumes grow.

Miners have an advantage in expanding into this space given their existing and strengthening relationships with OEMs. These relationships can create business growth, especially when miners can prove sustainable, responsible, and disclosable sourcing.

The truth is, how miners buy, operate, and disclose will define how they sell and who invests in them. Therefore, as miners expand into recycling, material traceability should be at the core of their strategy because those that have end-to-end visibility will be especially attractive to OEMS that want closed-loop, low-carbon, responsible, recycled content—and proof of it.

Q: What role can mining play in the circular economy?

Johnson-Poensgen: Although mining may seem at odds with the circular economy's goals of reducing resource consumption and waste, it plays a critical role.

It’s crucial that mining companies, policymakers, and other stakeholders collaborate to ensure that mining activities align with the principles of the circular economy... adopting sustainable practices, recovering valuable materials, and promoting responsible extraction and recycling.

This includes proving and authenticating the sustainability and responsibility of the products they produce, as well as adopting traceability throughout the entire supply chain. This promotes transparency and collaboration, ensures materials are used efficiently, and demonstrates closed loop value chains with battery manufacturers and OEMs.

Standards and audits alone won’t cut it...

What we need in this next phase—especially to grow critical minerals supplies—is the complementary coming together of audits and material traceability: that's when the game changes.

Q. What policy measures are needed to achieve better circularity?

Johnson-Poensgen: There are numerous industry regulations and voluntary practices currently in effect. But what we are seeing is some companies excel in embracing these, while others are struggling to meet the base requirements.

For example, the EU Battery Regulation mandates recycled content disclosure by 2028 and a content threshold by 2031. The U.S. Clean Vehicle Tax Credit offers up to $3,750 for vehicles with North American recycled materials. In the UK, the recent Battery Strategy recognizes recycling plays an essential role in meeting net zero targets and the government wants to encourage investment into the recycling of critical minerals.

Meeting these regulations...and tapping the potential value...means being able to demonstrate proof of circular, sustainable, responsible, regional production at the product level.

Q. What role will recycling play for critical minerals?

Johnson-Poensgen: Recycling is vital for securing future critical mineral supplies. Nonetheless, the IEA suggests that by 2040, recycled materials from batteries can only reduce primary supply needs for copper, lithium, nickel, and cobalt by approximately 10%.

For OEMs, establishing a traceable closed loop for battery assets into the next generation is crucial. They face growing Extended Producer Responsibilities to prove recycled content volumes and safe handling, aiming to ensure a reliable material stream and more resilient production.

Battery remanufacturing with recycled materials can achieve a 51% lower carbon footprint than battery production from raw materials (according to Science Direct researchers). In addition, the use of recycled aluminium (now included as a critical and strategic raw material in the EU CRMA) can reduce emissions by 95% compared with the production of aluminium from ore (according to Advanced Materials Journal).

Therefore, as embedded carbon becomes an increasing point of differentiation, downstream buyers will need low-carbon recycled content in their components—and upstream miners can create diversity and new opportunities for reduced emissions.

![Acculon RA Circulor - website image.001[44].png](/_next/image?url=https%3A%2F%2Fdecisive-wonder-fa24533282.media.strapiapp.com%2FAcculon_RA_Circulor_website_image_001_44_2720fb315d.png&w=1920&q=75)